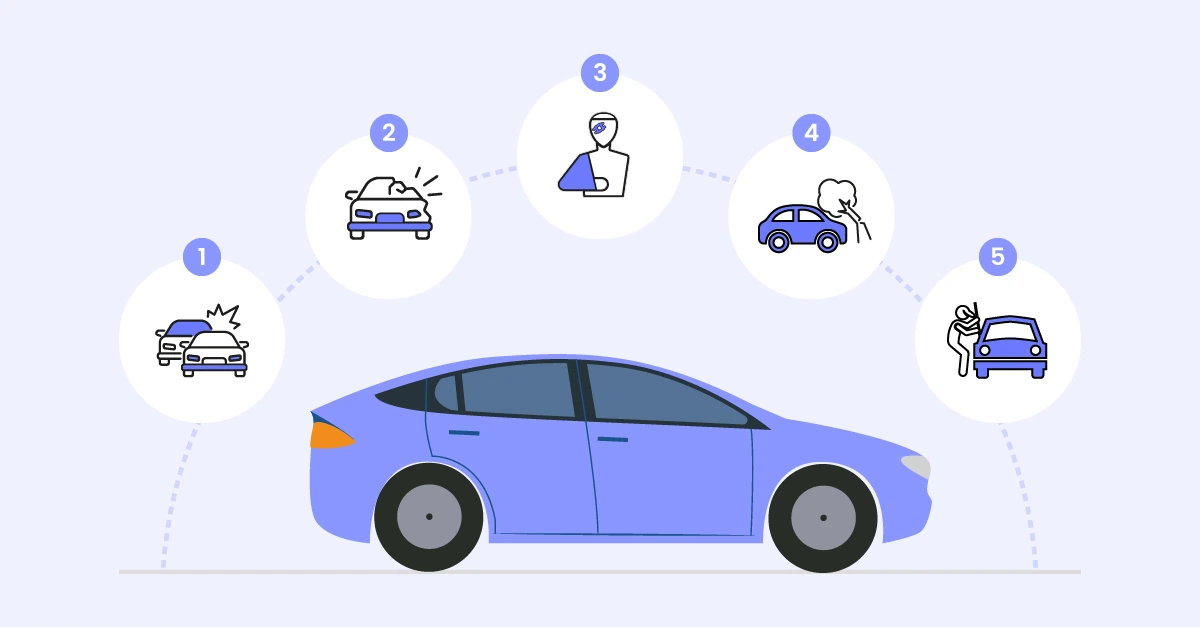

Car insurance comes in various types, each designed to address different risks and provide specific types of coverage. Understanding the different types can help you choose the right policy for your needs. Here’s a comprehensive overview of the main types of car insurance:

Liability Insurance

Purpose: Covers damages and injuries you cause to other people and their property in an accident where you are at fault.

- Bodily Injury Liability:

- Coverage: Pays for medical expenses, lost wages, and pain and suffering of the other party involved in the accident.

- Limits: Typically includes two limits—per person and per accident.

- Property Damage Liability:

- Coverage: Pays for repairs or replacement of the other party’s property, such as their vehicle, fences, or buildings.

- Limits: Usually has a single limit per accident.

Requirement: Most states require a minimum amount of liability insurance to drive legally.

Collision Insurance

Purpose: Covers damage to your own vehicle resulting from a collision, regardless of who is at fault.

- Coverage: Includes repair or replacement costs for your vehicle after a crash with another vehicle or stationary object.

- Deductible: Requires you to pay a deductible before the insurance covers the rest of the repair costs.

Requirement: Not required by law but often mandatory for leased or financed vehicles.

Comprehensive Insurance

Purpose: Covers damage to your vehicle from non-collision incidents.

- Coverage: Includes protection against theft, vandalism, natural disasters, falling objects, animal collisions, and fire.

- Deductible: Requires a deductible similar to collision insurance.

Requirement: Not required by law but recommended, especially for newer or valuable vehicles.

Uninsured/Underinsured Motorist Coverage

Purpose: Provides financial protection if you’re involved in an accident with a driver who either has no insurance or insufficient coverage.

- Uninsured Motorist Coverage (UM):

- Coverage: Pays for medical expenses, lost wages, and sometimes property damage when the at-fault driver lacks insurance.

- Underinsured Motorist Coverage (UIM):

- Coverage: Supplements your damages if the at-fault driver’s insurance is insufficient to cover your expenses.

Requirement: Required in some states and optional in others.

Personal Injury Protection (PIP)

Purpose: Covers medical expenses and other costs regardless of fault.

- Coverage: Includes medical bills, lost wages, and sometimes other expenses like childcare or household services.

- No-Fault Insurance: Often part of no-fault insurance systems where each driver’s own insurance covers their own expenses.

Requirement: Required in no-fault states and optional in others.

Medical Payments Coverage (MedPay)

Purpose: Provides coverage for medical expenses resulting from an accident, regardless of fault.

- Coverage: Pays for medical bills for you and your passengers after an accident.

- Limits: Typically has lower limits compared to PIP.

Requirement: Optional in most states.

Gap Insurance

Purpose: Covers the difference between the amount you owe on a financed or leased vehicle and its actual cash value in the event of a total loss.

- Coverage: If your vehicle is totaled and you owe more on your loan or lease than the car’s current value, gap insurance pays the difference.

Requirement: Optional but often recommended for leased or financed vehicles.

Rental Reimbursement Coverage

Purpose: Provides coverage for the cost of renting a vehicle while your car is being repaired due to a covered claim.

- Coverage: Pays for rental car expenses up to a specified limit and duration.

Requirement: Optional coverage that can be added to your policy.

Roadside Assistance

Purpose: Provides services in case of roadside emergencies, such as a flat tire, dead battery, or lockout.

- Coverage: Includes services like towing, jump-starts, tire changes, and locksmith services.

Requirement: Optional coverage that can be added to your policy.

Custom Parts and Equipment Coverage

Purpose: Covers aftermarket parts or customizations to your vehicle that are not included in the standard policy.

- Coverage: Includes repairs or replacement for custom parts, such as enhanced audio systems or custom wheels.

Requirement: Optional coverage, often added to comprehensive or collision policies.

Summary

- Liability Insurance: Required by law, covers damages and injuries to others.

- Collision Insurance: Covers damage to your vehicle from collisions, not required by law but often needed for financed or leased cars.

- Comprehensive Insurance: Covers non-collision-related damage, recommended for valuable vehicles.

- Uninsured/Underinsured Motorist Coverage: Provides protection if the at-fault driver is uninsured or underinsured, required or optional based on state laws.

- Personal Injury Protection (PIP): Covers medical expenses and other costs regardless of fault, required in no-fault states.

- Medical Payments Coverage (MedPay): Covers medical expenses for you and passengers, regardless of fault.

- Gap Insurance: Covers the difference between your loan/lease balance and your vehicle’s value if totaled.

- Rental Reimbursement Coverage: Pays for rental car expenses while your car is being repaired.

- Roadside Assistance: Provides help for roadside emergencies.

- Custom Parts and Equipment Coverage: Covers aftermarket parts and customizations.

By understanding the different types of car insurance, you can tailor your policy to suit your needs and ensure you have the appropriate coverage for various scenarios.